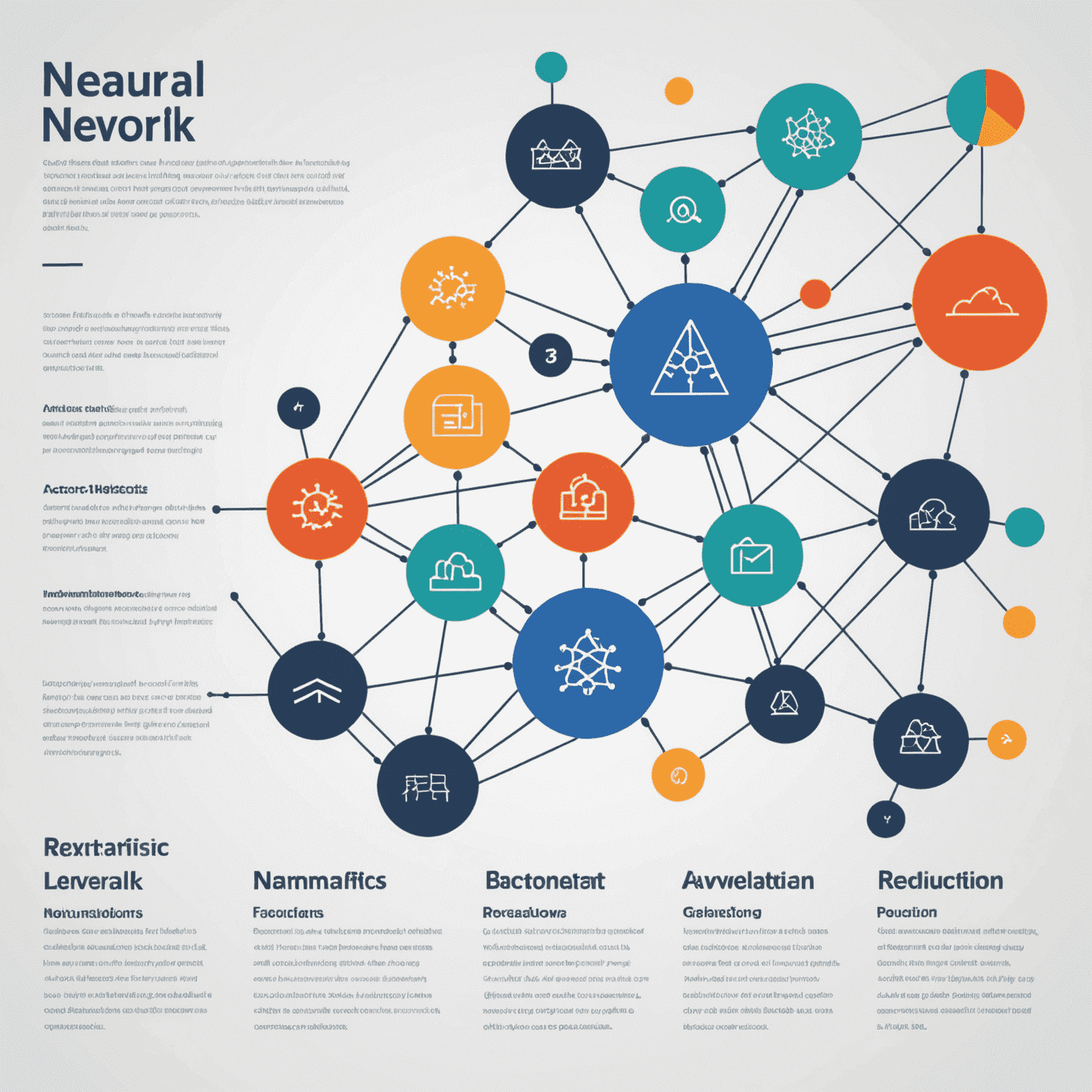

Understanding Neural Networks in Insurance Underwriting

Neural networks have revolutionized the way insurance companies assess risk and determine premiums. This article delves into the technical intricacies of how these artificial intelligence systems process vast amounts of data to make accurate underwriting decisions in the car insurance industry.

The Architecture of Neural Networks in Underwriting

At its core, a neural network used in car insurance underwriting consists of interconnected layers of nodes, mimicking the structure of the human brain. These layers typically include:

- Input Layer: Receives raw data about the policyholder, vehicle, and driving history.

- Hidden Layers: Process and transform the input data, identifying complex patterns and relationships.

- Output Layer: Produces the final risk assessment and premium recommendation.

Data Processing and Feature Extraction

Neural networks excel at processing large volumes of structured and unstructured data. In the context of car insurance, this includes:

- Demographic information

- Driving records

- Vehicle specifications

- Geographic data

- Claims history

The network's hidden layers perform feature extraction, identifying relevant risk factors that human underwriters might overlook. This could include subtle correlations between seemingly unrelated data points that impact risk assessment.

Training the Network for Accurate Risk Assessment

To achieve accurate risk predictions, neural networks undergo extensive training using historical data. This process involves:

- Supervised Learning: The network is fed labeled data pairs of input (policyholder information) and output (actual claim outcomes).

- Backpropagation: The network adjusts its internal weights to minimize the difference between its predictions and actual outcomes.

- Iterative Refinement: The training process is repeated with large datasets to improve accuracy and generalization.

Real-time Decision Making

Once trained, neural networks can make split-second underwriting decisions. When a new insurance application is received, the network:

- Processes the input data through its layers

- Applies learned patterns and weights

- Generates a risk score and premium recommendation

This enables insurance companies to provide instant quotes and streamline the underwriting process.

Continuous Learning and Adaptation

One of the key advantages of neural networks in insurance underwriting is their ability to continuously learn and adapt. As new data becomes available, the network can be retrained to:

- Incorporate emerging risk factors

- Adapt to changing market conditions

- Improve accuracy based on recent claim outcomes

Challenges and Ethical Considerations

While neural networks offer powerful capabilities for risk assessment, their use in insurance underwriting also presents challenges:

- Explainability: The "black box" nature of neural networks can make it difficult to explain specific underwriting decisions.

- Bias Mitigation: Ensuring that the network doesn't perpetuate or amplify existing biases in historical data.

- Regulatory Compliance: Adhering to insurance regulations while leveraging advanced AI techniques.

Conclusion

Neural networks have become an indispensable tool in modern insurance underwriting, particularly in the car insurance sector. By leveraging the power of artificial intelligence to process vast amounts of data and identify complex risk patterns, these systems are revolutionizing risk management practices. As the technology continues to evolve, we can expect even more sophisticated and accurate underwriting models, ultimately benefiting both insurers and policyholders alike.